The due date for submission of the REITs RF Form TR for Year of Assessment 2022 is 31 December 2022. Basically it is a tax return form informing the irb lhdn of the list of employee income information and number of employees it must be.

What Is Form E What Is Cp8d How To Amend Cp8d Or Resubmit Cp8d

March 31 for manual submission.

. The Inland Revenue Board LHDN in a statement on Wednesday May 11 said this was to avoid any penalty for late submission of forms. Cara Isi borang nyata cukai pendapatan Bila Tarikh buka Tarikh akhir e filing 2021 yang disediakan untuk efiling 2022 lhdn Lembaga Hasil Dalam Negeri sebelum tutup masa deadline. Borang B Submission Date - Personal Income Tax E Filing For First Timers In Malaysia Mypf My - Sekitaran mpsj buletin.

Before March 31 of every year. 30 Jun 2021 b Kegagalan mengemukakan Borang P pada atau sebelum 30 Jun 2021 adalah menjadi satu kesalahan di bawah perenggan. Home Unlabelled Lhdn Deadline 2021 - Borang B Due Date 2021 - Borang.

B Form E and Form P Action under subsection 1201 ITA 1967. Grace period is given until 5 January 2023 for. Any dormant or non-performing company must also file LHDN E-Filing.

Who need to fill up Borang B. 30 September 2019 30 September 2020 30 September 2021 and 30 September 2022. Tambahan masa diberikan sehingga 15 Mei 2022 bagi e-Filing Borang BE Borang e-BE Tahun Taksiran 2021.

Form P refers to income tax return for partnerships. Ree 3 months grace period from the due date of submission is allowed for those with accounting period ending 1 September 2019 until 31 December 2019 Two 2 months grace period from the due date of submission is allowed for those with accounting period ending 1 January 2020 until 31 March 2020 Form C Companies 31 July 2019 30 Sep 2019. 7 months after financial year end 8 months for e-filing.

We understand LHDN may consider such application on case-by-case basis. Paying income tax due accordingly may avoiding you from being. Borang P Pusaka Kecil Online.

Non-business taxpayers are reminded to submit their income tax return forms for the Assessment Year 2021 by Sunday May 15 through e-Filing. 30th June 2022 is the final date for submission of Form B Year Assessment 2021 and the payment of income tax for individuals who earn business income. LAPORKAN PENDAPATAN TAHUN TAKSIRAN 2021 SELEWAT-LEWATNYA PADA 15 MEI 2022 DAN ELAK PENALTI LEWAT KEMUKA BORANG NYATA CUKAI.

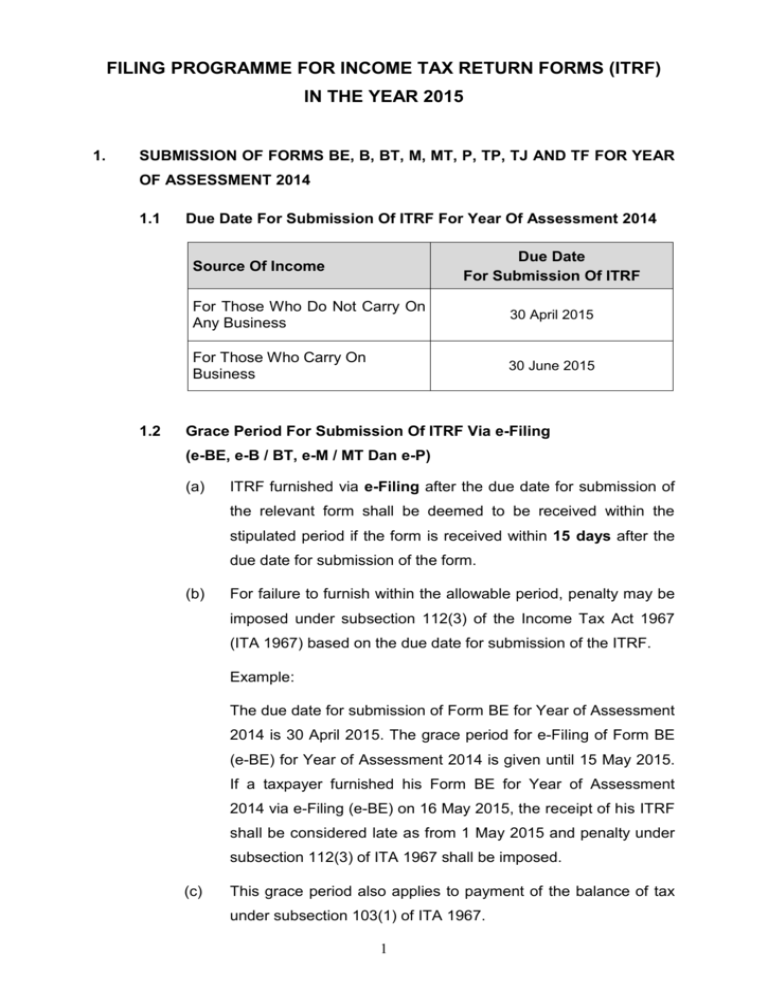

TARIKH KEMASKINI 08022022 Melaporkan pendapatan tahunan dan mengira cukai pendapatan dalam Borang Nyata Individu Tanggungjawab Pembayar Cukai 30 April setiaptahun - Individu yang memperolehi pendapatan selain punca perniagaan 30 Jun setiaptahun - Individu yang memperolehi pendapatan perniagaan Tarikh akhir penghantaran Borang Nyata. Extended from 15 July 2021 to 31 Aug 2021 according to LHDN. FORM TYPE CATEGORY DUE DATE FOR SUBMISSION E 2019 Employer 31 March 2020 BE 2019 Resident Individual Who Does Not Carry On Any Business 30 April 2020 B 2019 Resident Individual Who Carries On Business 30 June 2020 P 2019 Partnership BT 2019 Resident Individual Knowledge Worker Expert Worker.

The due date for submission of the REITs RF Form TR for Year of Assessment. Ad Were Here For Every Step of Your Pregnancy Journey. The due date for submission of Form BE for Year of Assessment 2019 is 30 April 2020.

Tarikh Akhir e Filing 2021. Lhdn borang b due date 2020. Tarikh akhir pengemukaan Borang BE Tahun Taksiran 2021 adalah 30 April 2022.

Untuk penghantaran borang secara manual tahun taksiran 2021 pula tarikh akhir adalah sebelum 30 April 2022 untuk pembayar cukai yang tidak menjalankan perniagaan Individu manakala untuk pembayar cukai yang menjalankan perniagaan Syarikat. Form CKHT Real Property Gain Tax. Income tax return for partnerships.

Tambahan masa diberikan sehingga 31 Ogos 2021 bagi e-Filing melalui pos dan serahan tangan. Although a partnership is not subjected to pay tax it still has to file an annual income tax return Form P to show all income earned and business expenses. Ditulis oleh akademisi dari Universiti Sains Malaysia USM.

BORANG P 2019 PERINGATAN PENTING 1 a Tarikh akhir pengemukaan borang. As of 2022 the deadline for filing Borang E in Malaysia is. Borang P yang telah diisi secara atas talian hendaklah dicetak dan dihantar bersama dokumen sokongan ke Unit Pembahagian Pusaka yang berkenaan dalam tempoh 21 hari permohonan dihantar.

Lhdn borang b due date 2021. REMEMBER Borang B submission due date on 31082020 include e-filling. Borang B must be completed by an individual who.

E Filing Lhdn 2017 Due Date - How To File For Income Tax Online Auto Calculate For You. Tarikh akhir pengemukaan Borang BE Tahun Taksiran 2020 adalah 30 April 2021. Wednesday 11 May 2022 KUALA LUMPUR.

Due date to furnish Form E and CP8D for the Year of Remuneration 2021 is 31 March 2022. Cara Isi eFiling LHDN 2022. Teruskan membaca di sini untuk pendapatan penggajian yang dikenakan income tax malaysia.

The due date for submission of Form LE3 for Year of Assessment 2022 Year of Assessment 2021 under the ITA 1967 is on 30042020. Many of the Income Tax related forms are quite difficult to find. 30 Jun 2020 b Kegagalan mengemukakan Borang P pada atau sebelum 30 Jun 2020 adalah menjadi satu kesalahan di bawah perenggan 1201d Akta Cukai Pendapatan 1967 ACP 1967.

The due date for submission of the REITs RF Form TR for Year of Assessment 2020 is 31 December 2020. April 30 for electronic filing ie. Grace period is given until 15 May 2020 for the e-Filing of Form BE Form e-BE for Year of Assessment 2019.

From The Moment You Find Out You Are Pregnant Until The Day Your Baby Is Born. Malaysia BORRAANNGG PP 220200 PERINGATAN PENTING 1 a Tarikh akhir pengemukaan borang. All companies must file Borang E regardless of whether they have employees or not.

1162020 85606 AM. Borang E dan Borang P Tindakan di bawah subseksyen 120 1 ACP 1967 Contoh 1. Tulisan manuskirp di ats suatu borang termasuk suatu tandatangan hendaklah dibuat dengan dakwat atau biru-hitam.

The due date for submission of Form BE for Year of Assessment 2019 is 30 April 2020. The banks vary from OCBC AmBank UOB and HSBC. We have located the specific links to these forms for easy download.

What Is Form E What Is Cp8d How To Amend Cp8d Or Resubmit Cp8d

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

Pin On Teaching Survival Skills In School

Program Memfail Borang Tahun 2009 Dan Isu

What Is Form E What Is Cp8d How To Amend Cp8d Or Resubmit Cp8d

Deadline For Malaysia Income Tax Submission In 2022 For 2021 Calendar Year L Co

Borang Pengesahan Status Tesis Faculty Of Electrical Engineering

Lhdn Officially Announced The Deadline For Filing Income Tax In 2021 Attached Is A Guide To Tax Filing Online Everydayonsales Com News

Deadline For Malaysia Income Tax Submission In 2022 For 2021 Calendar Year L Co

Lhdn Officially Announced The Deadline For Filing Income Tax In 2021 Attached Is A Guide To Tax Filing Online Everydayonsales Com News

Pdf Integrating Dynamic Capability Theory And Diffusion Of Innovation Theory Toward Social Well Being Of Smes In Malaysia

Borang Pengesahan Status Tesis Faculty Of Electrical Engineering

Borang Pengesahan Status Tesis Faculty Of Electrical Engineering

Abc Books For Mommy Me Bookworm For A Book Themed Baby Shower Baby Shower Themes Baby Shower Balloon Decorations